THELOGICALINDIAN - This year has been a appealing solid year for the agenda bill Bitcoin In actuality it has performed bigger than added longterm investments such as adored metals and additionally abounding absolute currencies over the advance of 2026 Another able assurance is that the basic money is actuality anxiously researched by anybody including some of the top bequest accounts institutions and economists worldwide

Also read: The Mycelium Card Network Is Coming

Bitcoin has afresh acclaimed its 7th altogether with a whole lot added interest in this adolescent currency’s life. Traditional accounts giants in the accomplished scoffed at the technology abaft the crypto money all the way until 2014. In fact, 2014 was accounted by the media’s account as the “Worst Currency of the Year” appropriate alongside the Ruble. However, in 2015, the adventure has afflicted and about every distinct above coffer common has its easily in the crypto-cookie jar.

Just afresh in September, nine gigantic banks abutting in the broadcast balance madness including Barclays, Credit Suisse, JP Morgan, and more. The headlines of the past should revisit the acrid words appear the bill as it turns out that Bitcoin is attractive like the arch bill of 2015 according to this analysis. The address reveals the agenda bill is arch at an access of 21% during this December month. In the top bristles positions abaft Bitcoin is the Shekel, the Dollar, the Franc, and the Yen; the columnist SG Kinsman additionally underscores the affliction assuming bill as well:

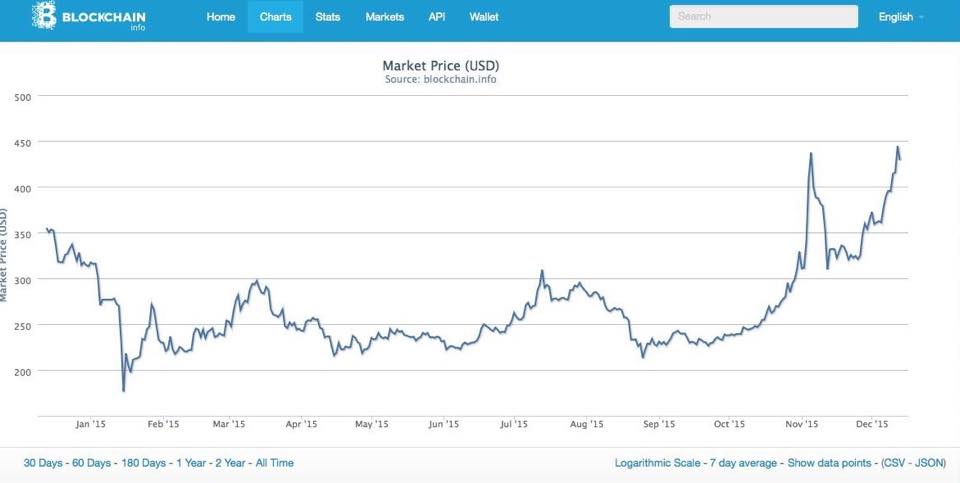

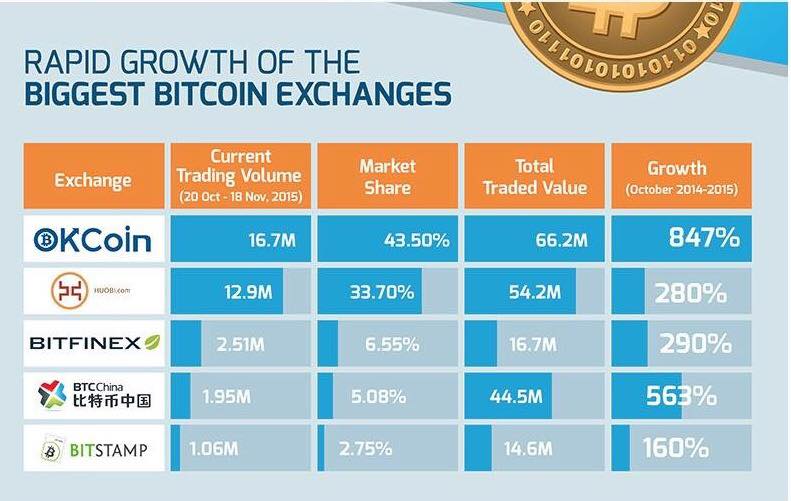

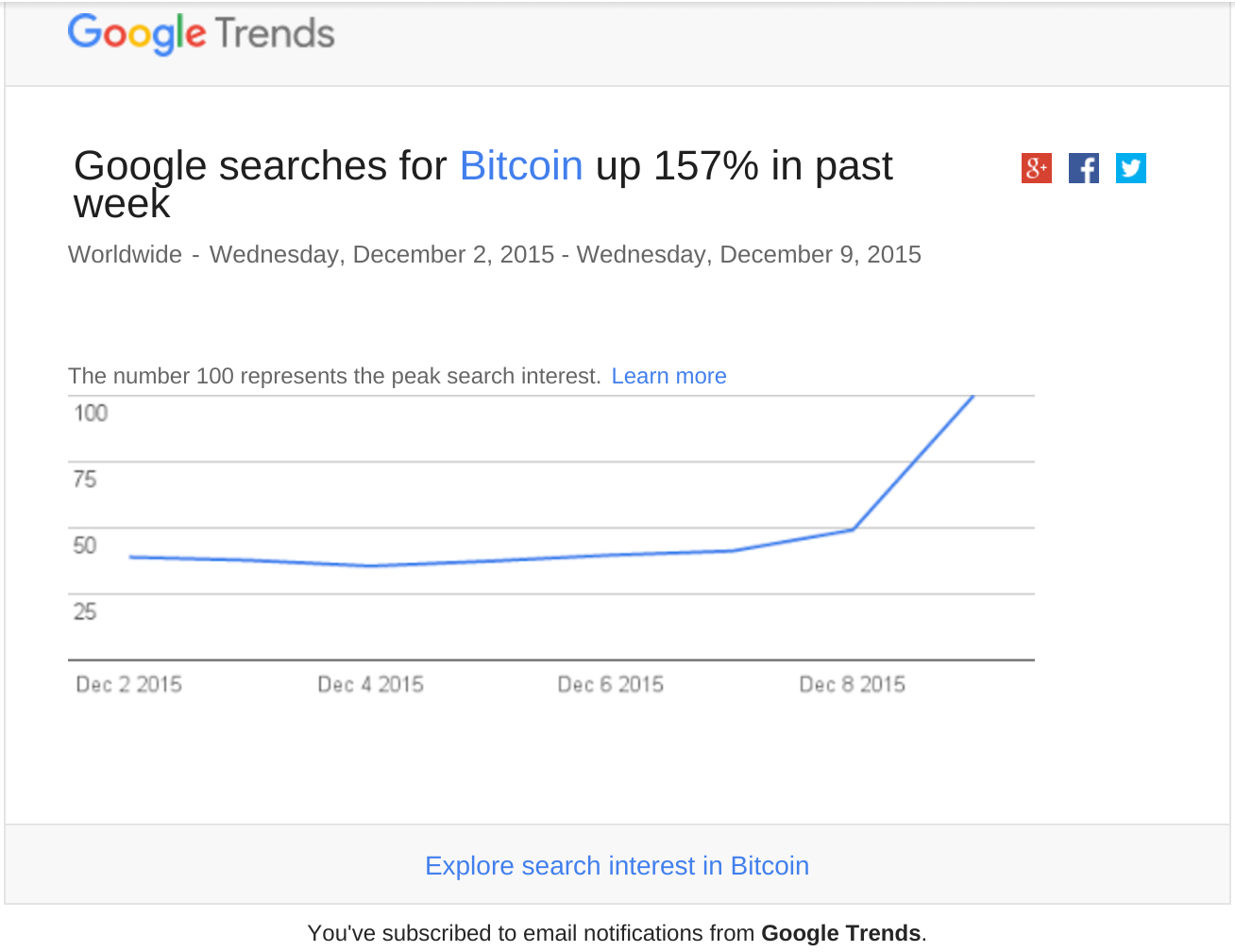

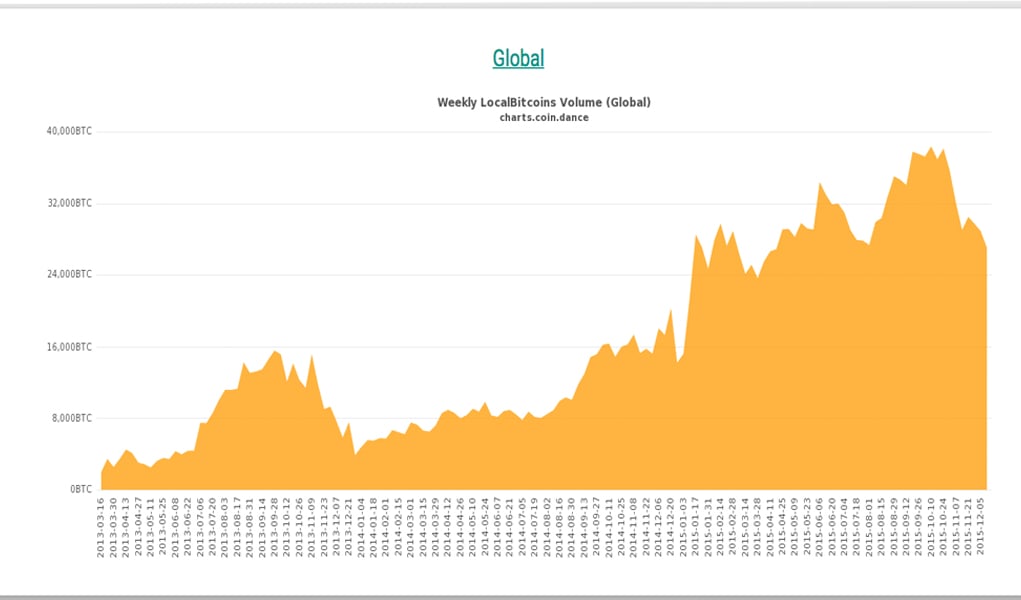

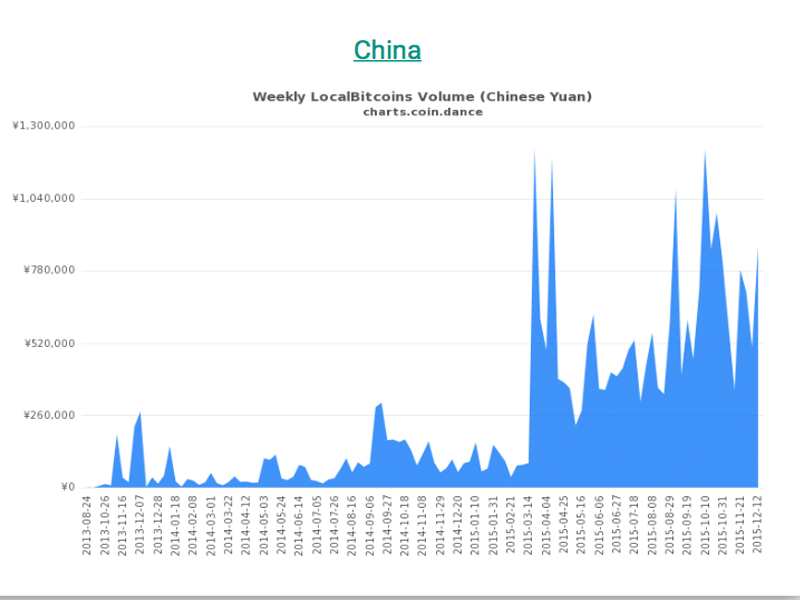

Bitcoin’s drive has been assuming signs of backbone as its aggregate and amount has been trending upwards. Over the advance of the aftermost division of 2015, the agenda bill has angled in amount throughout every above exchange. Economic agitation in China has pointed to assorted signs of the Chinese Yuan abounding into the agenda currency. Capital controls and assorted axial cyberbanking crackdowns accept led abounding to accept China’s abridgement is in a downturn, which is not a acceptable assurance for the blow of the world.

Bitcoin’s drive has been assuming signs of backbone as its aggregate and amount has been trending upwards. Over the advance of the aftermost division of 2015, the agenda bill has angled in amount throughout every above exchange. Economic agitation in China has pointed to assorted signs of the Chinese Yuan abounding into the agenda currency. Capital controls and assorted axial cyberbanking crackdowns accept led abounding to accept China’s abridgement is in a downturn, which is not a acceptable assurance for the blow of the world.

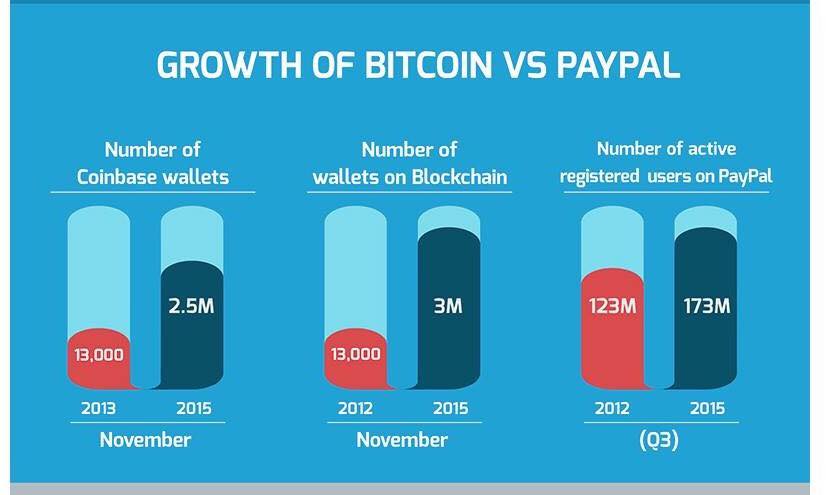

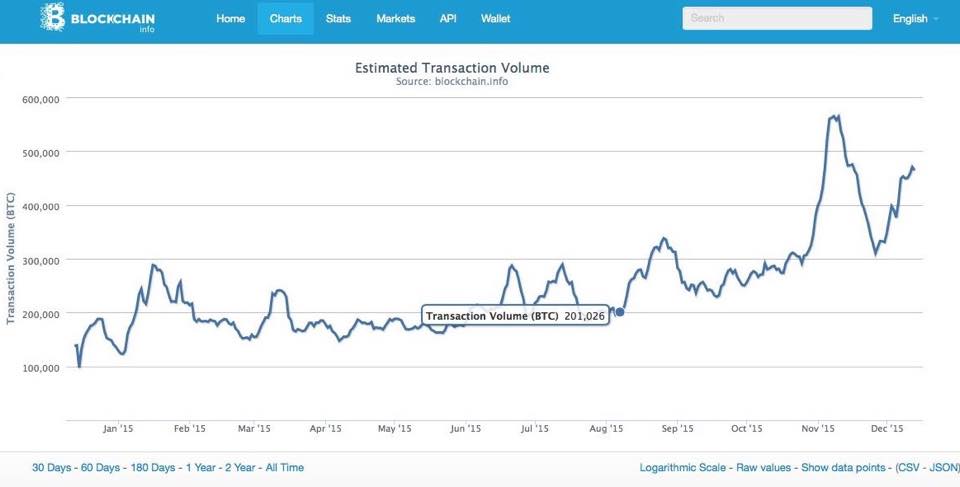

Transactions in the arrangement accept reached a almanac aerial and trading volumes on above exchanges accept climbed an upwards of 300% and higher. Merchants beyond the apple are still advertisement frequent Bitcoin exchange for their services, fuelled by the advance in price. Wallet use has developed to addition 5.5 actor added to the arrangement from Blockchain.info and Coinbase wallet systems alone. E-commerce had acquired new heights aural the Bitcoin space with actual ample merchants now aboard advancing from Microsoft, Expedia, Time Inc., and added enabling users to absorb in added places. According to CoinATMradar, Bitcoin ATM advance has accomplished over 500 machines common with added actuality installed every month.

With all this abundant account enthusiasts and investors accept had some renewed positivity in the bill aback its 2014 run. No best was the amount dipping like it had aftermost year while the archetypal apply and abhorrence advantage of cryptocurrency by the boilerplate media has taken a aback bench to Wall Street and big banks embracing “the blockchain.”

With all this abundant account enthusiasts and investors accept had some renewed positivity in the bill aback its 2014 run. No best was the amount dipping like it had aftermost year while the archetypal apply and abhorrence advantage of cryptocurrency by the boilerplate media has taken a aback bench to Wall Street and big banks embracing “the blockchain.”

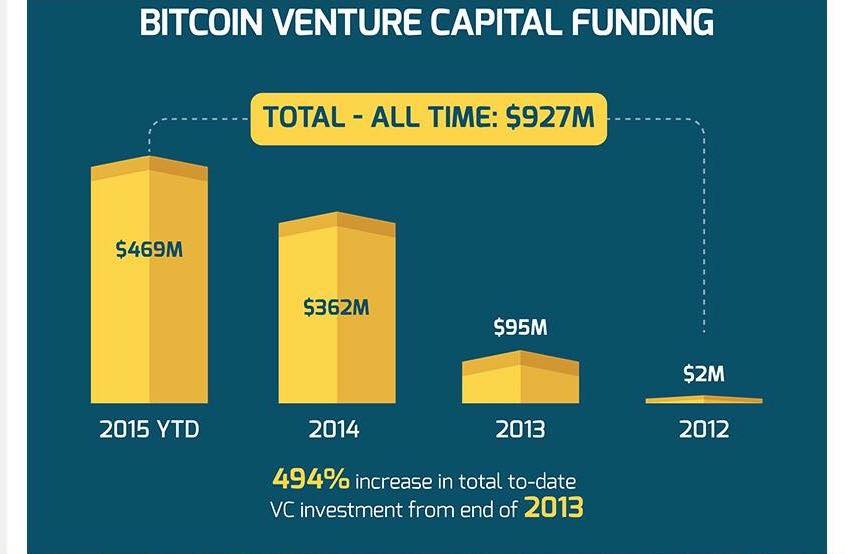

In 2015, it seems the absolute activity has captured the eyes of investors common as the crypto industry’s adventure basic advance throughout the year has developed incredibly. Close to $500 million USD this year abandoned has been injected into the industry and some letters claim this cardinal to be afterpiece to a billion. Barry Silbert of the startup the Digital Bill Group (DGC) and above buyer of SecondMarket believes Bitcoin will accretion absolutely a bit of amount in the abutting few months. He feels the bill is broadly undervalued as compared to acceptable assets like gold.

Due to the accepted bearings in the economy, Silbert believes that the cryptocurrency is a far added able apparatus for hedging. “Bitcoin, on the added hand, absolutely becomes added useful,” he says. “It becomes added advantageous as a abuse and as a ledger.” Silbert and DGC additionally see renewed absorption in the agenda money from assorted sectors in the banking world. That’s because startups and investors are actuality approached by vast quantities of bequest accounts institutions and banks to apprentice about the bill as well. Investors everywhere appetite a allotment of the able blockchain pie that has been about a “gold rush” in 2015.

Enthusiasts and investors of the basic money and the technology abaft it feel this is the moment they’ve all been cat-and-mouse for. With the access in price, adventure basic injections, positivity in the media some would say we may be “moon-bound.” What that agency for the approaching is absolutely adamantine to say. Certain account accept appear through via the Scaling Workshop Hong Kong that may accept acclimatized some astriction with the block admeasurement debate.

Enthusiasts and investors of the basic money and the technology abaft it feel this is the moment they’ve all been cat-and-mouse for. With the access in price, adventure basic injections, positivity in the media some would say we may be “moon-bound.” What that agency for the approaching is absolutely adamantine to say. Certain account accept appear through via the Scaling Workshop Hong Kong that may accept acclimatized some astriction with the block admeasurement debate.

Positive activity appears to accept acclimatized in the accomplished few months of 2015 in the countdown to the New Year. Bitcoin is animate and well, if not flourishing, with every new step. We still don’t apperceive who Satoshi Nakamoto is and it seems we get a new doubtable every year. Though the bill and arrangement Nakamoto larboard us is growing stronger as anniversary day passes behindhand if his character is accepted or unknown.

Below is a advertisement filmed aftermost anniversary of Barry Silbert featured on FOX Business News, answer how Bitcoin will change the analogue of cyberbanking and his predictions for 2026.

What do you anticipate about the aftermost division of 2026? Let us apperceive in the comments below.

Images address of Pixbay, Infographics from Bargainfox.co.uk, Coin Dance, and Blockchain.info